Behind the Code: How AppealZoo® Streamlines Real Estate Tax Workflows

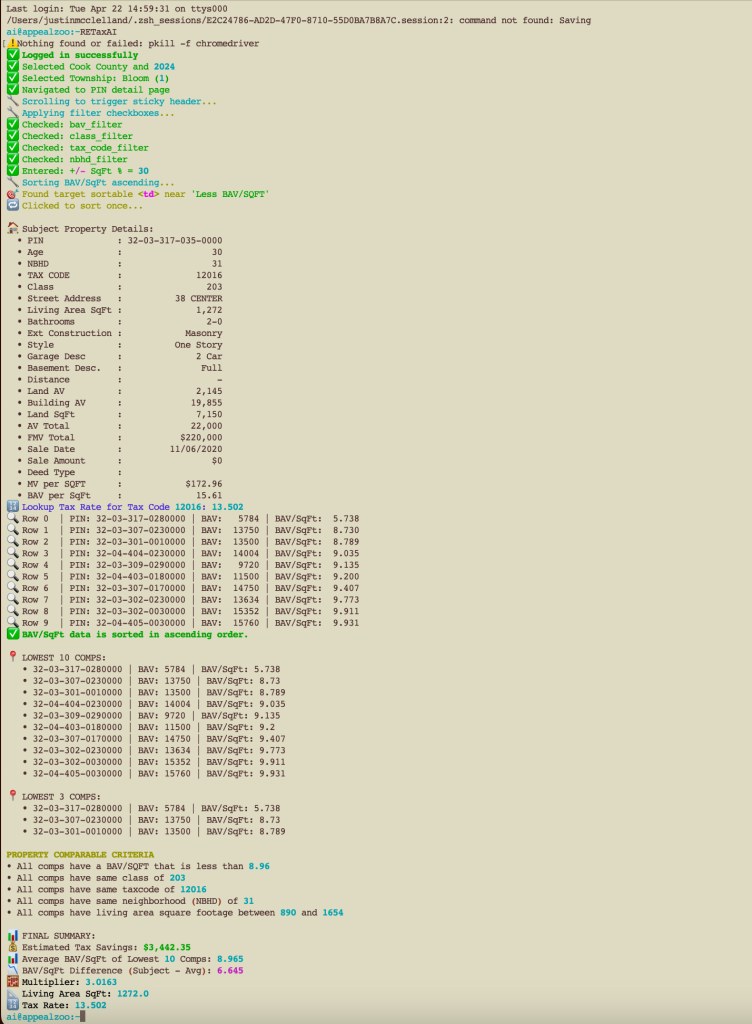

In the video, we demonstrate how the AppealZoo® AI command-line interface (CLI) allows real estate tax analysts to complete powerful, time-saving tasks without all the spreadsheets or complicated processes. Here’s what each part of the walkthrough shows, step by step:

1. Launching the CLI Tool

We begin by opening the terminal and running the CLI script.

The interface responds right away and prompts the user to enter the subject proerty Property Index Number (PIN).

2. Entering the Property PIN

The user enters the PIN of the subject property.

The tool immediately pulls in property data by connecting to our internal database and external sources integrated with the AppealZoo® platform.

This includes key information like current assessed values, sales history, property 壯陽藥 class, tax code, neighborhood code, and historical data.

3. Running the Assessment Equity Check

The CLI automatically performs an assessment equity check.

It applies filters based on user input, such as same property class, similar building square footage, and the same neighborhood or tax code.

It then calculates both assessed value per square foot and market value per square foot for each comparable property, benchmarking the subject property against them.

4. Generating the Fairness Analysis

The tool evaluates whether the subject property is fairly assessed.

If the assessment appears out of line with similar properties, the tool clearly flags it and explains the difference in plain, easy-to-read language.

This helps the user quickly decide if an appeal is likely justified, along with an estimated tax savings calculation.

5. Creating a Summary for Reporting

Once the analysis is complete, the CLI generates a clean, ready-to-use summary.

The format is fully customizable to the user’s needs.

Whether you want to add it to an appeal packet, internal documentation, or send it to a property owner, the output is designed to be flexible and professional.

6. Why This Matters

What used to take 30 minutes per property can now be done in under 30 seconds.

This tool is not here to replace analysts.

It is built to empower them, eliminate repetitive tasks, and help firms scale efficiently while focusing their expertise where it counts most.

Ready to Learn More?

If you’re ready to put this tool to work in your office, get in touch with us for a personal walkthrough.

###

The Real Estate Tax Newsletter

Get exclusive updates, insider strategies, and expert insights on real estate tax appeals delivered straight to your inbox. Whether you’re a property owner looking to cut costs or a professional in the industry, our newsletter keeps you informed and ahead of the game.

✔ Pro tips for lowering your property taxes

✔ Breaking news on tax assessment changes

✔ Data-driven insights from industry experts

Join now and never miss a key update.